top of page

Connect, Aggregate

and Analyze

Fund@mental is the premier professional technology platform within the wealth management community.

Its utilization of advanced research ensures unbiased access to the finest investment products and top-tier analysis.

Easy sharing

Simple by design.

Powerful by necessity.

Access our Insights with

the click of a button

Leverage

Risk taking continues to accumulate on this market. Discussions about the “bubbleness” are not stopping investors from piling up on leverage, wether through traditional margin, or through vehicles that incorporate the loans in its creation, like leveraged ETFs. In the chart below you can see how both are trending up. On the bottom one, traditional leverage has reached $1.2Tn, which dwarfs the prior peaks of 2000 and 2008. On the top, the financial engineering of the leveraged

Gustavo A Cano, CFA, FRM

Nov 281 min read

Deficit breakdown

The U.S. Department of the Treasury released yesterday its Monthly Treasury Statement (MTS) for October 2025, revealing a federal budget deficit of $284.35 billion for the first month of fiscal year 2026. This figure marks a 10.4% increase from the $257.45 billion deficit recorded in October 2024. While the headline number suggests fiscal pressures are intensifying, a deeper analysis reveals a mix of one-off timing effects, policy-driven revenue boosts, and lingering disrupti

Gustavo A Cano, CFA, FRM

Nov 272 min read

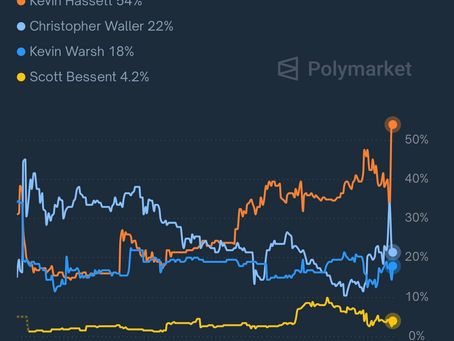

The chosen

The Trump administration, through Treasury Secretary Bessent is finalizing the list of candidates for the Fed chair job. From the list, one can only infer that what the president is looking for is someone loyal, that is able to go beyond statistics and models to justify what’s needed. And what’s needed will be determined by the president, for the most part. The independence of the Fed will be deemed secondary, because the U.S. economy is at a point where everybody has to push

Gustavo A Cano, CFA, FRM

Nov 262 min read

Round trip

Just two weeks left of the last FOMC meeting of 2025, and the market has flippped the odds of a cut once again. And the round trip has happened within November. With no data on inflation and unemployment to make informed decisions, investors feared the Fed was not going to venture into additional cuts with the risk of increasing inflation. Then a 150 years study on tariffs effect on inflation by the San Francisco Fed popped up, providing some tehnical background supportive of

Gustavo A Cano, CFA, FRM

Nov 251 min read

DAT and Bitcoin

Bitcoin has been the poster child of every risk on strategy. Over the last 15 years, it has been the most profitable asset by far, except in 2014, 2018 and 2022, when it’s been the worst. Although it doesn’t have a long history, it looks like it shows cycles of 4 years with big swings up and down. And perhaps investors have detected that seasonality and have decided to arbitrage that. Over the last month and a half, Bitcoin has fallen more than 30%, questioning once again its

Gustavo A Cano, CFA, FRM

Nov 242 min read

Pause or the beginning of the end?

It looks like investors are debating wether the risk on trade should continue to roll. Over the last few years, the “buy the dip” strategy has worked very well, and passive strategies have had no competition vs traditional active ones, since you needed to have perfect timing to avoid the drawdowns and reinvest the money. “Time in” has beaten “timing”. Now look at the chart below: Thursday’s put volume was the 4th biggest ever in th CBOE, which if we take it as contrarian indi

Gustavo A Cano, CFA, FRM

Nov 231 min read

New plan, old habits

Japan’s Cabinet, under Prime Minister Sanae Takaichi, approved yesterday a comprehensive economic stimulus package valued at ¥21.3 trillion ($135 billion). This marks the largest such initiative since the COVID-19 pandemic and represents Prime Minister Takaichi’s first major policy move since taking office in October 2025. The package aims to counteract a recent economic contraction (Japan’s GDP shrank by 1.8% annualized in the July-September quarter) and wants to address per

Gustavo A Cano, CFA, FRM

Nov 222 min read

The10 am algo club

About 70% of all the trading in the US stock markets is done by algorithms. For F/X and derivatives it goes up to 80%. One of the most widely used trading strategy is known as VWAP (Volume Weighted Average Price), which basically looks at periods during a trading day with high volume, and tries to execute large block orders at that time to benefit from the liquidity. If 30% of the trading volume occurs in the first 2 hours, the machine will try to execute 30% of its order dur

Gustavo A Cano, CFA, FRM

Nov 212 min read

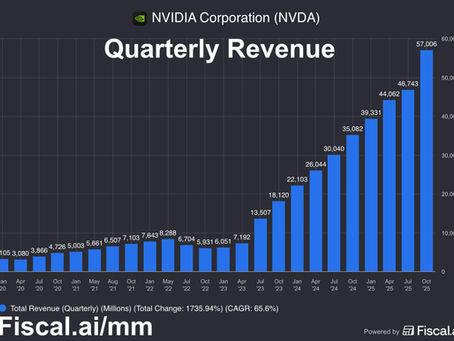

Priced to perfection

NVDA results were published yesterday. Since it is the poster child of AI, and has become the backbone of the market and quite frankly, the economy, its financial health, has a huge impact on almost everything. In terms of revenues, the results are impressive. Revenues were up 62% YoY with a net income increase of 109%. That’s the impressive part. The worrisome part is the surging inventory ↑96% and the increase of +45% on accounts receivables, which implies declining Cash

Gustavo A Cano, CFA, FRM

Nov 201 min read

The Yen Carry Trade

For 30 years if not more, global investors have benefited from the Yen Carry Trade (YCT). The operation is simple: you borrow at very low rates in Yen, to invest in high yield or high return assets elsewhere, mainly in the US. If the Yen stays stable or weakens, you make a killing. But rates in Japan have started to go up, because for the first time in 30 years, and after spending a fortune in monetary stimuli, Japan has a little bit of inflation. As a consequence short rate

Gustavo A Cano, CFA, FRM

Nov 191 min read

The governor speech

Federal Reserve Governor Christopher Waller addressed the Society of Professional Economists in London yesterday, emphasizing the use of economic theory and data to assess the U.S. economy amid a 43-day government shutdown that delayed official statistics. The title of the speech was “the case for continuing rate cuts”. His main points were: (1) weakening labor market, attributed to weak labor demand, (2) inflation under control, with tariffs causing one-off increases, but wi

Gustavo A Cano, CFA, FRM

Nov 181 min read

Earnings scorecard

The third-quarter 2025 earnings season for S&P 500 companies has been robust, with strong beats on earnings and revenue expectations despite some sector variability. As of mid-November 2025, 91% of the companies in the index have reported, here are some numbers: (1) 82% of reporting companies have beaten EPS estimates, surpassing the 5-year average of 78%. The aggregate earnings surprise stands at +7.0%. (2) Blended Revenue growth was 8.3%, the highest since Q3 2022, exceedin

Gustavo A Cano, CFA, FRM

Nov 171 min read

Split worries

The credit market continues to offer some warning signs, and unless things change, we might be close to a turning point. The chart below shows the avegare price of bonds that have split rating by agency, in the riskier frontiers of the credit spectrum. You can see that for BBB/BB and BB/B, there is still some stability, after the liberation day shock. But the B/CCC price difference has sinked below the April lows, which is an indication that investors are demanding more yield

Gustavo A Cano, CFA, FRM

Nov 161 min read

Voila!

The Fed has started to understand they might need to lower interest rates irrespective of their views on the economy. So they have started to document their epiphany. In the chart below, you can see a study by the Federal Reserve of San Francisco, where the review 150 years of tariff data an conclude that tariffs are in fact deflationary, and they end up increasing unemployment. The top part of the chart refers to the period where tariffs are enacted, and the bottom part show

Gustavo A Cano, CFA, FRM

Nov 151 min read

Marking the Market

Private funds are a hot topic today. After the episode of First Brands and the “cockroaches” comment from Jamie Dimon, they are being subject of an increasing scrutiny. At the center of that scrutiny is their valuation policies. How do you value a private asset that by definition is not subject to market forces? It besomes an art, particularly in times of stress. The chart below is a good example of how subjective valuations can be, and the dangers associated with private ass

Gustavo A Cano, CFA, FRM

Nov 141 min read

CPI pressure

With the government shutdown, the US has not had an official source of goods pricing for the economy. Private sector measures and other indicators have been used in their absence and all of them seem to indicate that inflation is starting to show up on the numbers again. As you can see in the chart below, more than half of the goods in the CPI basket have experienced a price increase of at least 3%, while the Fed’s official target continues to be 2%. This is due to tariffs a

Gustavo A Cano, CFA, FRM

Nov 131 min read

Negative Risk premia

New all time high for the Dow Jones Industrial Average, the least tech heavy index of the three majors (18%). The Nasdaq 100, with almost half of its components in the the sector, is still hustling to regain its peak from 2 weeks ago. Is there any value left to support the push for new highs? It’s getting more difficult to answer yes to that question, both in absolute and relative terms: on one hand, earnings continue to come strong, although their quality has decreased sign

Gustavo A Cano, CFA, FRM

Nov 121 min read

All In on AI

Bond investors are starting to see the actual cost of building the AI infrastructure in the U.S. in the chart below, you can see the 5 year Credit Default Swaps (CDS) for the Banking sector and the Tech sector. Despite the fact that banks are going through a tough period, with low liquidity levels in the short term market, the perception of risk by bond investors is mostly muted. For the tech sector, however, the fact that organic cash flow can only satisfy half (if at all) o

Gustavo A Cano, CFA, FRM

Nov 111 min read

Affordability

We start the week with the good news about the reopening of the U.S. government, which has been closed for a record 40 days. But there is a full laundry list of items that are problematic for the Trump administration. Among them: The SCOTUS decision on tariffs, which doesn’t look good at this point, inflation and high short rates, which are squeezing the middle class, and housing affordability. In the chart below you can see two charts that would indicate the American dream i

Gustavo A Cano, CFA, FRM

Nov 102 min read

Give n’ take

The current market concentration phenomenon has been discussed extensively. Concentration at company level, with the mag 7 wonder, at sector level, with the AI related companies responsible of 75% of the S&P500 gains since the introduction of chatGPT on November 2022, and concentration at country level, where the U.S. dominance has been exceptional over the last 15 years. These companies have created an unprecedented level of dependency for the world. To the point that the wo

Gustavo A Cano, CFA, FRM

Nov 92 min read

©2024 Fund@mental. All rights reserved

bottom of page