All roads lead to inflation

- Gustavo A Cano, CFA, FRM

- Sep 1, 2025

- 1 min read

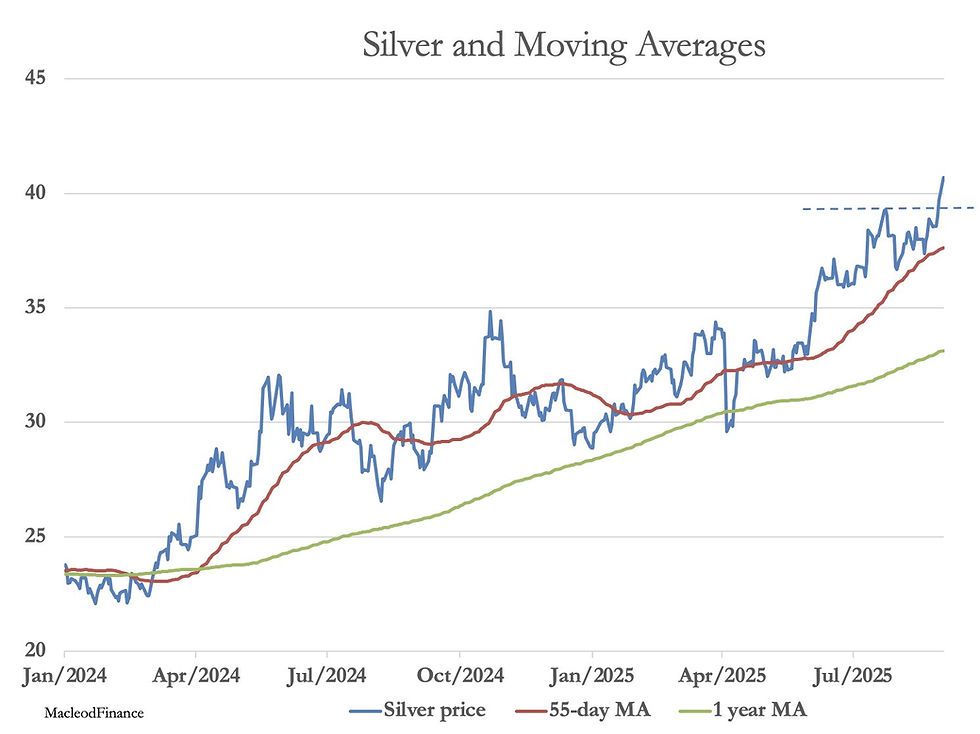

As we get into the worst performing month of the year, historically speaking, silver is just breaking out the $40 mark. Gold is also on a run to $3500, and may reach that barrier today as well. Investors may be implementing a hedge against what seems inevitable: President Trump wants lower rates on top of lower taxes and tariffs. For fiscally responsible market participants, this is like squaring a circle, and it’s an exercise that will lead to higher inflation. The fact that both precious metals are gaining momentum, is telling you the dollar will continue to weaken, pressured by deficits and the national debt. That’s why not only precious metals are up, commodities in general are up as well, perhaps showing us the start of the second inflation wave, like it happened in the 80’s. Electricity prices, pushed by the lack of proper infrastructure and brutal AI consumption, is also inflationary, and it will start showing up on consumers bills. We may be starting a new cycle, and the bond market is the last confirmation we need. So far it has been muted. Let’s see what happens as we approach this Friday’s unemployment number and the FOMC Sept meeting.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments