top of page

Connect, Aggregate

and Analyze

Fund@mental is the premier professional technology platform within the wealth management community.

Its utilization of advanced research ensures unbiased access to the finest investment products and top-tier analysis.

Easy sharing

Simple by design.

Powerful by necessity.

Access our Insights with

the click of a button

YTD AI scorecard

Six weeks into the new year and AI related companies are sragging the market. They are using most of their Free Cash Flow (please see first chart below) to finance data centers and AI related research, and still need to tap the credit markets to fullfill all those commitments. In the second chart below, you can see the impact on the economy predicted by several studies on AI. Look at the Horizon column. They’re talking about decades to hit the real economy meaningfully, while

Gustavo A Cano, CFA, FRM

2 hours ago1 min read

Mounting pressure

The stars are aligning for Trump when it comes to the future of oficial interest rates. first the unemployment report on Wednesday where the overall number was not bad, but showed enough weakness, particularly after the adjustments, to reaffirm the narrative of soft employment, and yesterday the inflation report showed CPI slightly better than expected, but just enough to set the stage for the Fed to conclude that tas should be lower. Are the number being “tortured” to confes

Gustavo A Cano, CFA, FRM

1 day ago1 min read

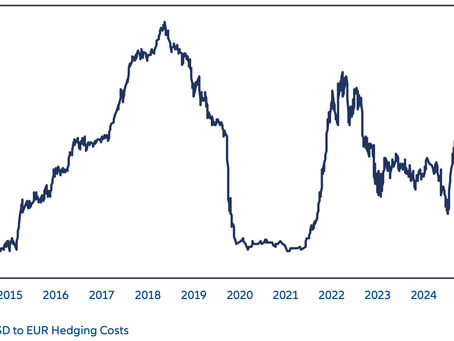

Hedging

Let’s take another look at the rotation out of the U.S. narrative. For years, investing out of the U.S. has been a bad decision, as returns have been far superior than most international markets fueled by technology, and AI in particular. But there was also the currency component. Hedging the dollar has made little sense for most institutional investors as there was al yield pickup between U.S. short rates and European, or Japanese rates, for example. But as the valuation gap

Gustavo A Cano, CFA, FRM

2 days ago1 min read

International hype

Global Equity indices are showing investors that the real performance to be made, at least so far this year, is out of the US. Peru, Mexico, Colombia or Japan have had a espectacular start of the year and are already showing double digit returns while the US has barely moved after a couple of strong years. Is that a dollar play or a valuation play? Or is it both? Is it a sign that the AI hype is taking a breather? It may seem so, as the valuation gap between the S&P500, which

Gustavo A Cano, CFA, FRM

3 days ago1 min read

Birth-death adjustment

The U.S. unemployment report will be published today. The consensus estimate points to a 4.4% unemployment rate, which is considered full employment for a developed economy. But the real story is the another employment report, the non farm payrolls. It measures the change in the number of people employed during the previous month, excluding the farming industry. But it needs to be adjusted once in awhile, to take into account jobs created by new businesses, and job losses due

Gustavo A Cano, CFA, FRM

4 days ago2 min read

Ultra long

Alphabet has announced a new bond sale to raise money for data centers. It’s going to be a 100 year bond, which contrary to short term hype, may indicate that Google sees data centers business as a long term project, that will need to go through the typical tech cycle. This is positive long term, but it shows there is a disconnect between the short term hype amd the long term value. They want to raise $15bn, at least initially and it appears that the initial demand is for $90

Gustavo A Cano, CFA, FRM

5 days ago1 min read

Japan’s snap elections

Japan concluded a snap general election yesterday for all 465 seats in the House of Representatives, the lower house of its parliament. Prime Minister Sanae Takaichi, who became Japan’s first female prime minister in October 2025, called the election just over 100 days into her term to secure a stronger mandate for her policies. Takaichi achieved a historic landslide victory, winning 316 seats on its own. She has pledged for stimulus and tax cuts, estimated to create a 10 t

Gustavo A Cano, CFA, FRM

6 days ago2 min read

Unemployment

On Wednesday, the U.S. will publish its unemployment report. The market Consensus expects a 4.4% unemployment rate, which continues to be structurally low, despite being on the rise recently. The participation rate is expected to be around 62%, which means that the U.S. still 38% of the active population that is not looking for a job. But perhaps the most interesting factor helping the employment numbers is that the pool of people that are eligible to work is shrinking. You c

Gustavo A Cano, CFA, FRM

Feb 82 min read

Another winter

Bitcoin seems to be preparing for another crypto winter. 16% nose dive this week, below $70,000, and more than 45% from its peak in October. This is Bitcoin Achilles heel: out of the three qualities needed to be considered money, the storehold of wealth is a key one, and the historical high volatility episodes that Bitcoin has experienced, brings a lot of doubt about its ability to be considered money. There are a lot of speculators in crypto, and even though the U.S. govern

Gustavo A Cano, CFA, FRM

Feb 72 min read

Unbalanced

The economic machine continues to move away from equilibrium. Silver is experiencing manipulation and wild swings, falling 40% in 5 days, while Bitcoin took a nose dive to $61k yesterday and is trying to find a floor, even when it seems to be trading below the cost of mining. And then the correlation between the yen and the rate differential between the 10 year U.S. treasury bond and the 10 year JGB, has broken. You can see how both diverge in the chart below. This is very im

Gustavo A Cano, CFA, FRM

Feb 61 min read

Mismatch

The AI world is starting to look a lot like the real estate market in ghost cities in China. An incredible push in data center infrastructure, to the tune of $600Bn (see chart below), built for an expectation of demand that may not be there, at least in the short term. The usage for model trainings could be there, but the revenues associated with the use of those models, may not be present yet. And there lies the problem, the mismatch between the debt used to build those data

Gustavo A Cano, CFA, FRM

Feb 51 min read

AI and software

The month of January was positive for the S&P500. The January barometer tells us that the year should be positive as well, with a probability of 70-80%. It has been particularly strong for small caps which went up between 6-8%. There may be a rotation in size going on in 2026. What has started as a laggard, continuing a trend from 2025, is the software sector. As you can see see in the chart below, the drawdown that’s started at the beggining of the 4th quarter last year, con

Gustavo A Cano, CFA, FRM

Feb 41 min read

Trouble in paradAIse?

We’re waking up this morning with renewed concerns about the well being of our AI industry, in this case from the point of view of credit. Open AI is the epicenter of the worries, and Oracle, NVDA, and the BDCs are starting to revive the shock waves. Oracle is trying to raise capital, through equity and debt, to continue funding its AI bet, which has cost them dearly in terms of their CDS and their stock price. It already has a negative outlook on its rating by S&P and if thi

Gustavo A Cano, CFA, FRM

Feb 32 min read

Market stress?

The week is starting trying to recover from the 7 standar deviation movement in the price of silver on Friday. The probability of that event happening is lower than 1 divided by the age of the universe (by far). Let that sink in. Of course we know the real world does not follow a perfect normal distribution of returns. This is what’s called a fat tailed event. Why is that important? Because it implies that something more complex is going on in the market. This morning we saw

Gustavo A Cano, CFA, FRM

Feb 22 min read

The silver episode

We are starting to see wild movements in the market, which unfortunately seem adequate in periods of high uncertainty, high leverage, high valuations and high concentration. The poster child these days is silver, but we can see movementa like these in other assets. On Friday, silver price in the U.S. fell 30% in a day. It was options expiration day, banks were massively short the metal, and they moved the market as if they were the masters of the Universe. And perhaps they ar

Gustavo A Cano, CFA, FRM

Feb 12 min read

What’s next for the Fed?

Kevin Warsh will be the new Fed chairman starting in May, pending confirmation from the Senate. He has both private and public experience and brings strong ideas for the Fed, which he has criticized for years on balance sheet policy and interest rates views. But who is Kevin Warsh? He’s from Albany, NY, Stanford graduate on public policy and JD by Harvard as well as HBS and MIT Sloan school of management. At age 35, Warsh became the youngest-ever member of the Federal Reserve

Gustavo A Cano, CFA, FRM

Jan 312 min read

The new Chair

President a Trump announced yesterday the he was going to nominate the Fed chairman today. Although we don’t have any insights to who that person will be, Polymarket (see chart below) odds for Kevin Warsh jumped onmmeditely to 80% after a reported mentions that the news leaked out. Since Trump is unpredictable, we might see a last minute change, but this will not be a surprise. To welcome the new Fed chairman, the precious metals market woke up this early morning with a big

Gustavo A Cano, CFA, FRM

Jan 301 min read

Someone else

The Fed left rates unchanged, on the basis that the economy is growing at a solid pace. According to the oficial statement, inflation remains elevated and unemployment is weak, but not weak enough to justify a cut. Stephen Miran, the latest governor appointed by Trump, voted in favor of another cut, signaling once again lack of consensus on the decision. But this is no news, as it was expected, the same way that rates were not expected to be lowered. The post rate decision ro

Gustavo A Cano, CFA, FRM

Jan 291 min read

Risk is rising

The Fed will conclude the first FOMC meeting of 2026 today. No rate cuts are expected, but the press conference at 2pm EST will provide more infoamtion on the current thinking of the Central Bank. One of the topics that is gaining momentum is the dollar. Comments made by President Trump yesterday, taking importance off the recent weakness of the grenback sent the currency to new lows. It remains within the recent normal range but is approaching the lowest part of it, which s

Gustavo A Cano, CFA, FRM

Jan 281 min read

Tectonic shifts

The macroeconomic tectonic plates continue to move under the surface, indicating a potential change in the fiat currency system might be brewing underneath what appears to be a normal functioning world. The head of the IMF, Kristalina Georgieva, has publicly stated the world needs to build an alternative to U.S. dollar assets in case the greenback loses its status as a safe haven. She calls for European bonds, to act as an alternative to U.S. treasuries, in the latest attempt

Gustavo A Cano, CFA, FRM

Jan 271 min read

©2024 Fund@mental. All rights reserved

bottom of page