There is no risk-free path

- Gustavo A Cano, CFA, FRM

- Dec 11, 2025

- 2 min read

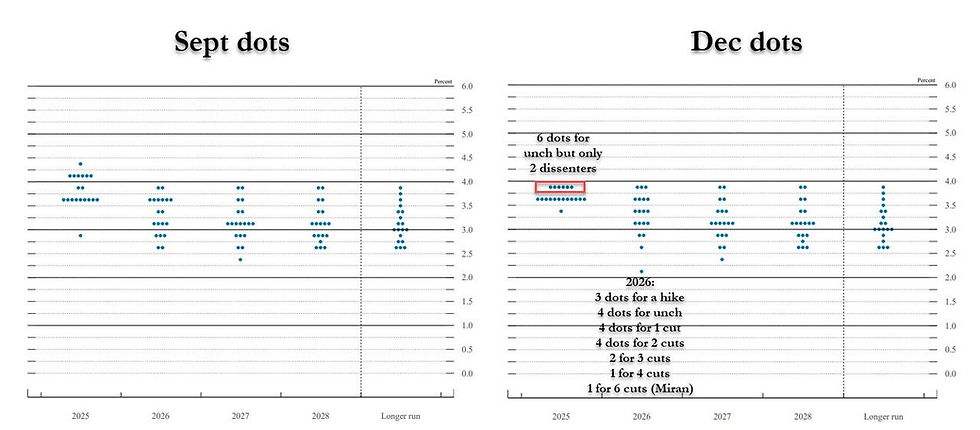

The FOMC concluded its final meeting of 2025 yesterday, announcing a widely expected 25 basis point (0.25%) cut to the federal funds rate, lowering the target range to 3.50%-3.75%. This marks the third consecutive rate reduction this year, bringing the total easing since September 2024 to 175 basis points. The FOMC noted moderate economic expansion but highlighted elevated inflation and rising downside risks to employment. In terms of future rate path: Median expectation point to just one more 25 basis point cut in 2026, followed by another in 2027, stabilizing near a neutral 3% long-term. However, projections were unusually wide, with seven officials expecting no cuts in 2026 and others advocating up to four. When asked during the press conference about the risk to higher inflation and rise in unemployment, Powell answered “there is no risk free path”, acknowledging the challenge the Fed is embedded in. Regarding the balance sheet, Powell announced the Fed will stay purchasing $45Bn in T-bills tomorrow, proceeding with similar amounts on a monthly basis, and introduced another acronym for U.S. to learn: RMP (Reserve Magement Purchases). The goal of the RMP is to buy shorter-term Treasury securities, to maintain an ample supply of reserves in the banking system. In other words, there is a problem with liquidity in the banking system, and the Fed needs to have securities available for Reverse Repo to make sure liquidity in banks doesn’t clog. Stock markets and bonds reacted positively; gold amd silver shoot up as well, but bitcoin sold the news after buying the rumor.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments