Bending the knee

- Gustavo A Cano, CFA, FRM

- Aug 21, 2025

- 1 min read

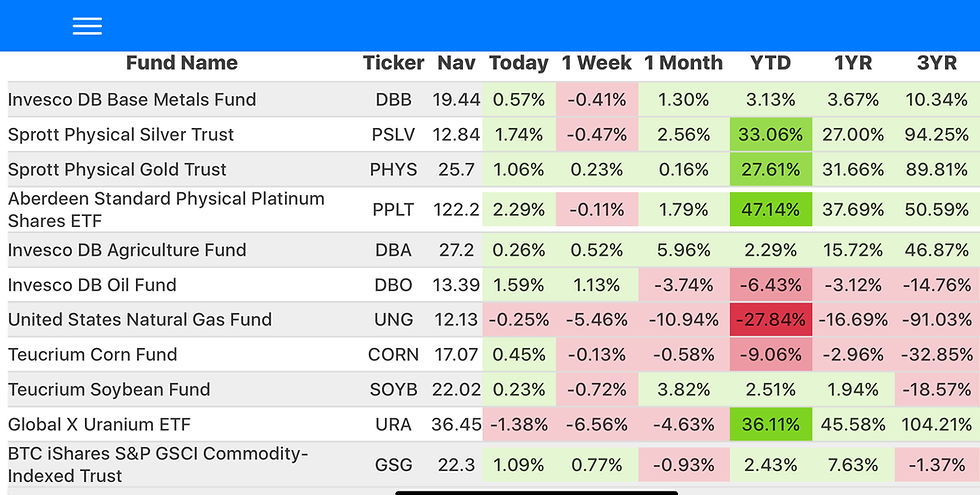

Rumors are starting to circulate around Jerome Powell speech on Friday, regarding his stance on inflation and on interest rates. He’s expected to offer a more dovish approach to rates. The White House keeps applying pressure, now accusing a Fed governor of mortgage fraud, cutting through the independence line like a knife on hot butter. But the truth of the matter is that facts are piling up behind the prudent approach from the Fed chairman: tariffs are going to impact the US consumer and as you can see below, commodities prices are picking up, particularly metals, and will likely be followed by others, such as grains and energy. Perhaps the most important point in this discussion is that the goal of lowering interest rates is to have lower interest cost from government debt. But that will only have an immediate effect on the short term bills the government keeps rolling out every year; it will not have an impact on the long end (at least it’s not clear), which will not allow the treasury to extend durations, which is the ultimate goal. Furthermore, it make have the opposite effect. And we may end up with a more volatile Fed rising and cutting rates more frequently that will bring an erosion in confidence on the institution.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Source: Fund@mental market monitor

Comments