Downgrades

- Gustavo A Cano, CFA, FRM

- Sep 13, 2025

- 1 min read

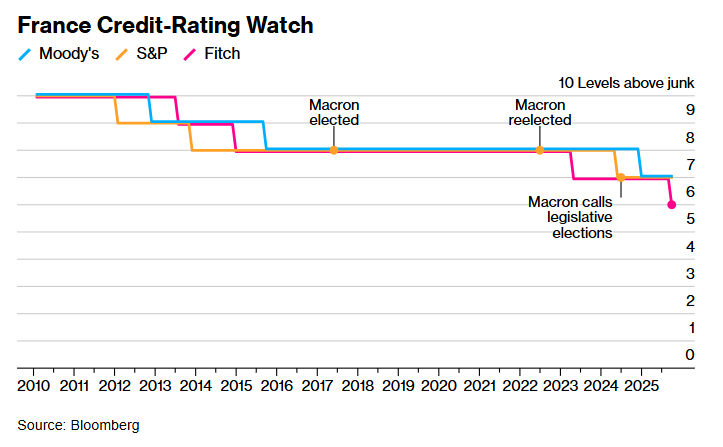

Yesterday, Fitch decided to downgrade France to A- from AA. The fiscal situation of most developed countries is deteriorating so rapidly that rating agencies are taking action. Downgrades are like rouches, there’s always more than the one you see. After the U.S. and France, the UK and Japan may follow. Deficits and debts are becoming very costly for governments, and that’s going be reflected in their credit scorecards, which will push yield curves up. And that is the transmission mechanism into corporates: as basis yield go up, spreads, which are now at, or near, all time lows, start to pick up, reflecting the change in risk profile. The tactic of performing downgrades in a Friday afternoon is designed to minimize market impact, until investors start to anticipate them, and then it becomes something normal, sometimes even an opportunity. This downgrade may be an indication that (sovereign) credit risk has reached the low point of this cycle.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments