Emerging opportunities

- Gustavo A Cano, CFA, FRM

- Aug 17, 2025

- 1 min read

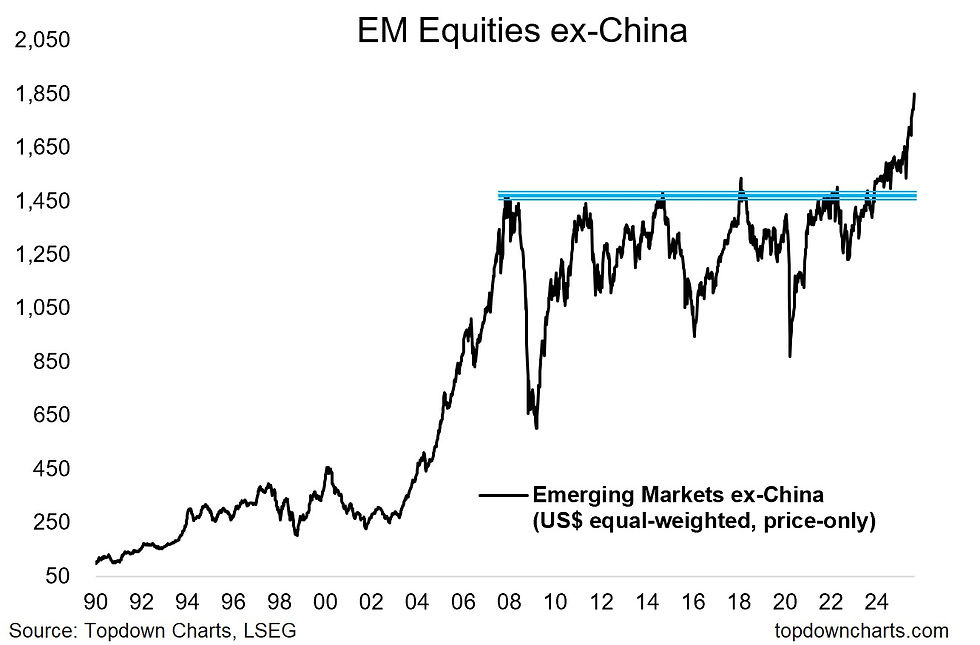

Aside from the rotation from the U.S. to Europe, there is a other important decision that money managers are making. After 7 years of stagnation where flows have preferred developed markets, Emerging market equities are receiving attention again. If we exclude China, the average debt to GDP ratio for emerging market economies is 75% vs 128% for the G5. And most of their debt is in local currency, unlike prior episodes where hard currency debts weighted in their economies and their currencies, and evaluation was inevitable. Growth is healthy, they have raw materials which are being demanded, and in an inflationary environment tend to perform well relative to other asset classes. But the most compelling argument is perhaps valuation; for EM ex-China the Forward P/E is calculated between10-12. For the G5, Forward P/E is around 17. Are they more volatile than the developed peers? Yes. Is the rule of law as transparent and trusted as in developed markets? Surely not. But everything has a price, and investors are looking at EM again.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments