Golden tariff

- Gustavo A Cano, CFA, FRM

- Aug 8, 2025

- 1 min read

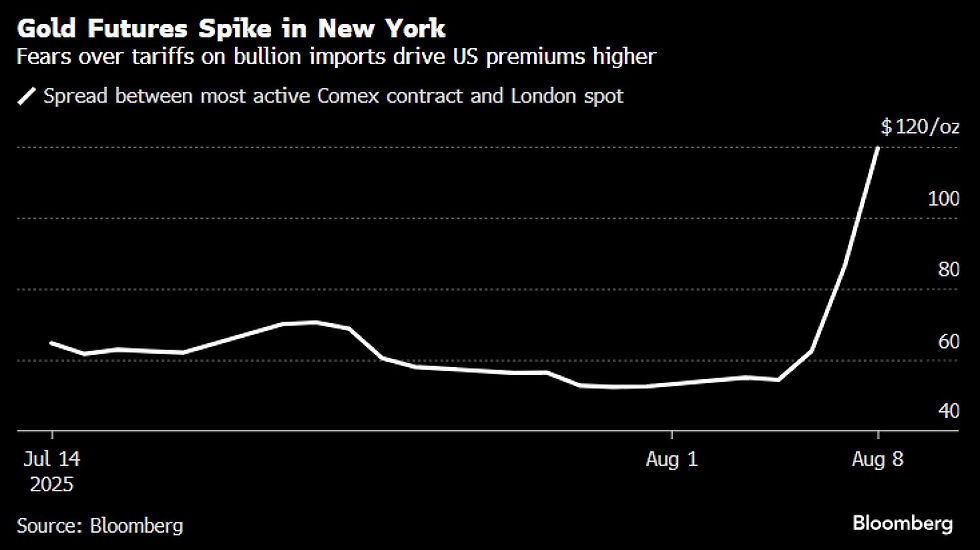

The US just imposed a 39% tariff on 1 kilogram and 100 ounce gold bars from Switzerland. That is the exact formats COMEX accepts for delivery in the U.S. This is important because Switzerland is the world’s largest gold refining hub, and a substantial share of the physical gold that underpins COMEX futures flows from there. In practical terms, it means that deliverable supply into the U.S. market has abruptly tightened. What’s the purpose of this move? The US has 260 million oz of gold at the Fed valued at $42.5 per ounce. Trump has already mentioned that he will update the value of those gold reserves, creating $800bn out of thin air at current gold prices. But if more pressure is applied and gold prices are pushed up due to tariffs, he can get a revaluation of more than $1Tn. In the chart below, you can see how the newly imposed tariff works on the spread between futures contracts and spot prices. It is now 39% more expensive than yesterday to deliver a bar of physical gold into the U.S., the main futures market. President Trump is on a mission to squeeze other countries to pay for the U.S. deficit and justify his OBBB.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments