Headline vs effective tariffs

- Gustavo A Cano, CFA, FRM

- Aug 5, 2025

- 2 min read

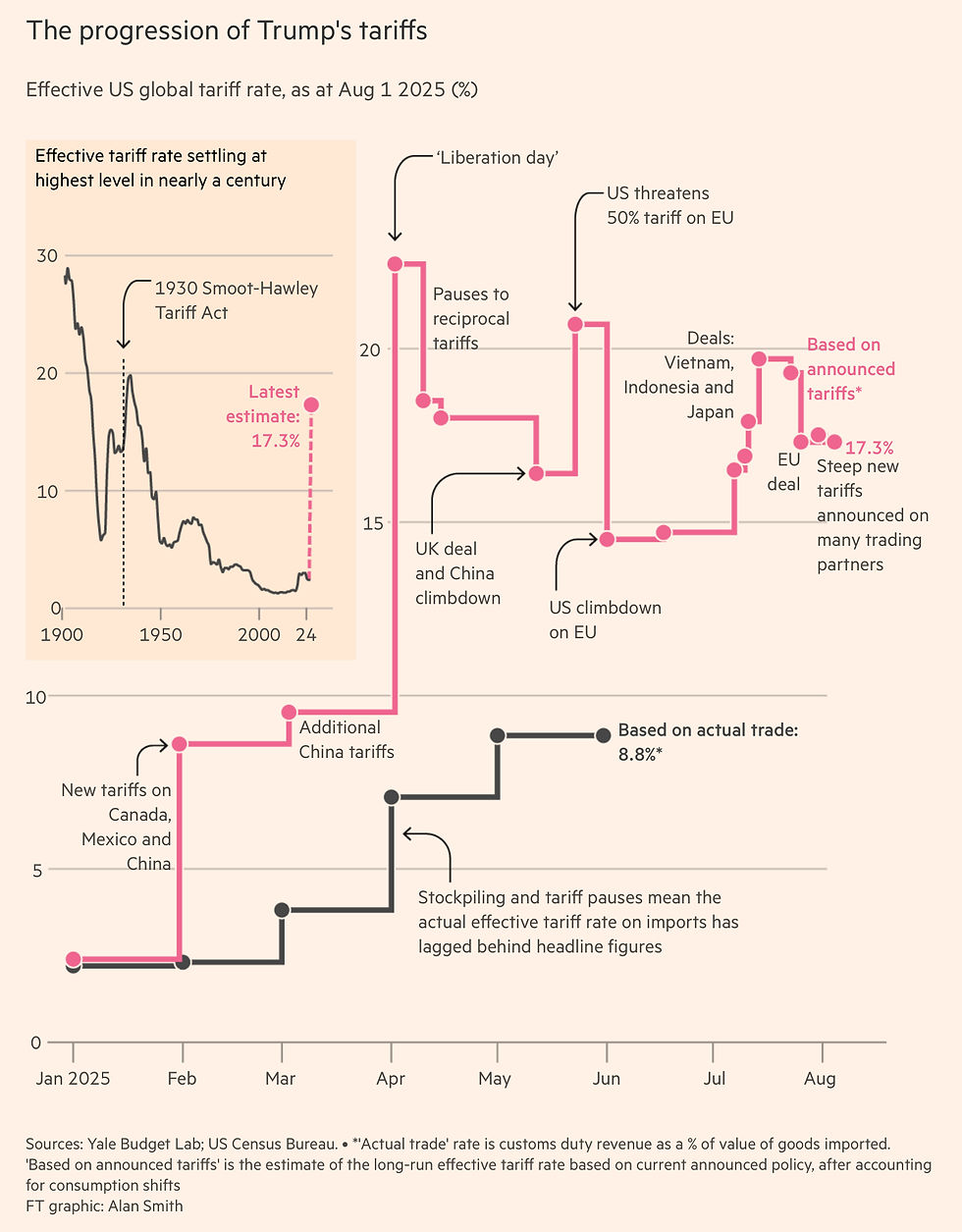

Economists and investors have been debating since liberation day, and arguably, since the first Trump administration, if tariffs are paid by the consumer, and therefore are inflationary for the importing country, or if they are paid by the exporting country, and have little to no effect on inflation. Evidence so far, does not bring a lot of light one way or another, since inflation has picked up a couple of decimal points that may be considered a rounding error. The chart below shows a more dissecrional approach: it compares the headline (announced) average tariffs with the effective ones, based on actual goods imported into the US. To put it simply, you can put 100% tariffs on Komodo dragon meat, but if it’s not imported, the net effective tariff is zero. When you do that exercise with all goods imported by the U.S., you can see that the effective average tariff collected by the U.S. is 8% over the value of all goods imported, while the headline, which has been incredibly volatile, is basically double that figure (17.7%). Is 8% tariff enough to move the inflation needle? It should be, but it gets watered down by the CPI and PCE calculation method. The important point is, if tariffs do not discourage trade (which is not clear), the effective tariff and the headline one should converge, and the most probable path is for the effective to catch up to the headline one. We could see inflation picking up before year end, while labor reports get scrutinized to understand if unemployment is deteriorating more rapidly than anticipated.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments