How do we make interests interesting?

- Gustavo A Cano, CFA, FRM

- Aug 18, 2025

- 1 min read

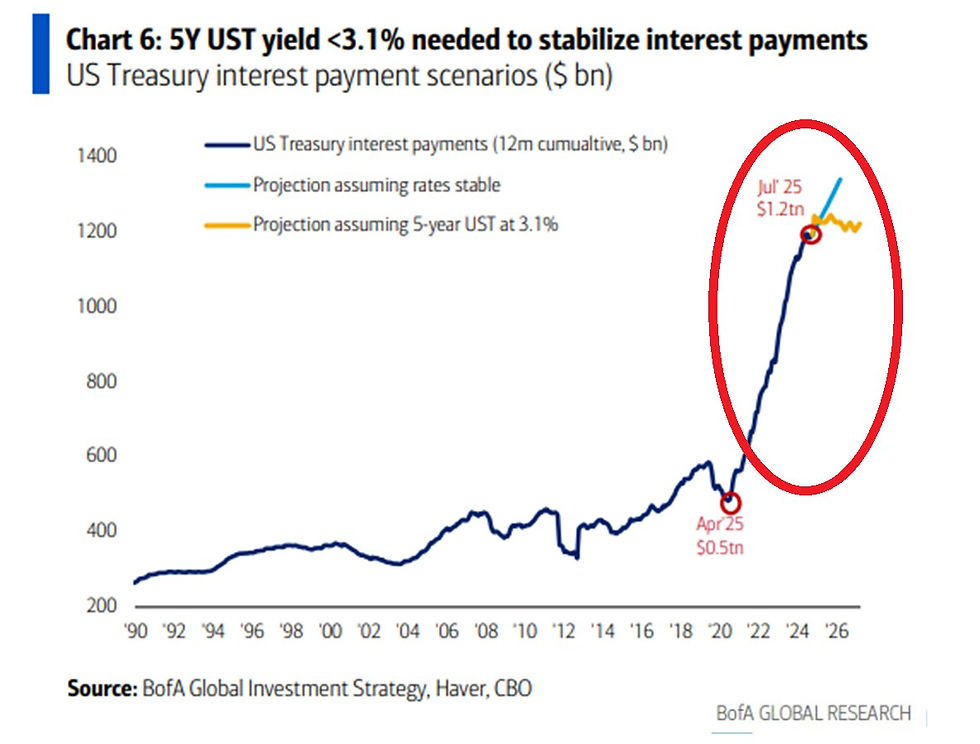

The bond market keeps waiting for the drama of interest rates and inflation to unfold. The short end of the U.S. treasury curve is already pointing to a reduction in rates and the long end seems to be undecided. But undecided is better than rising, as it’s happening in the UK, Japan or Germany. For the U.S. the key is to be able to rollover current debt at lower yields extending maturities to lock in rates for the next decade, while AI produces the (perhaps unrealistic) results needed to balance the budget. How low do interest rates need to be for the U.S. to stabilize interest payments. According to the chart below, the 5 year treasury (used as a benchmark) will need to yield less than 3.1% for payment to remain still. Currently, it yields 3.82%, which is not that far from the goal. But the question is if it will remain at that level when Mr Bessent auctions trilllions of dollars of existing and new debt. What will the narrative be for investors to buy at those levels when core CPI is rounding 3% as well. Who would buy a bond at almost zero real rate? And how can you lower inflation when you are applying tariffs left and right? You need a crisis.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments