Inconclusive

- Gustavo A Cano, CFA, FRM

- Aug 13, 2025

- 2 min read

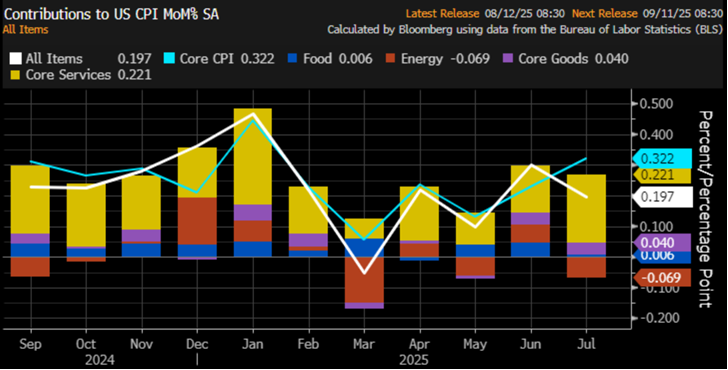

The inflation report published yesterday for the month of June was mixed; the headline number came in line with expectations, but the core came slightly hotter than expected. From the White House perspective, it was a success because prices went up as expected, but more importantly, goods inflation was not an issue. So far, they can still defend the case that tariffs are not inflationary. What is becoming an issue, and you can see it in thr chart below, is the Core services inflation. It is consistently the biggest contributor to inflation and it has been only offset, in some instances, by the energy component, which happens to be a deflationary component at this point, due to production increases by OPEP. The Fed however, doesn’t share that view. In the last press conference, J Powell argued that every forecaster he follows predicts inflation will pick up as a consequence of tariffs (which makes sense), and for that reason, he would like to wait for more evidence to adjust monetary policy. In the other side of the spectrum,Trump will keep putting a lot of pressure on Powell, naming Fed governors aligned with his view of the world to push his message from the inside. In addition, the secretary of Treasury is already very vocal about the need for a 50 bps rate cut in September to compensate for the inaction so far this year. The key to this fight is in the hands of the bond market. That’s the ultimate judge when it comes to inflation.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments