Policy adjustment

- Gustavo A Cano, CFA, FRM

- Aug 23, 2025

- 1 min read

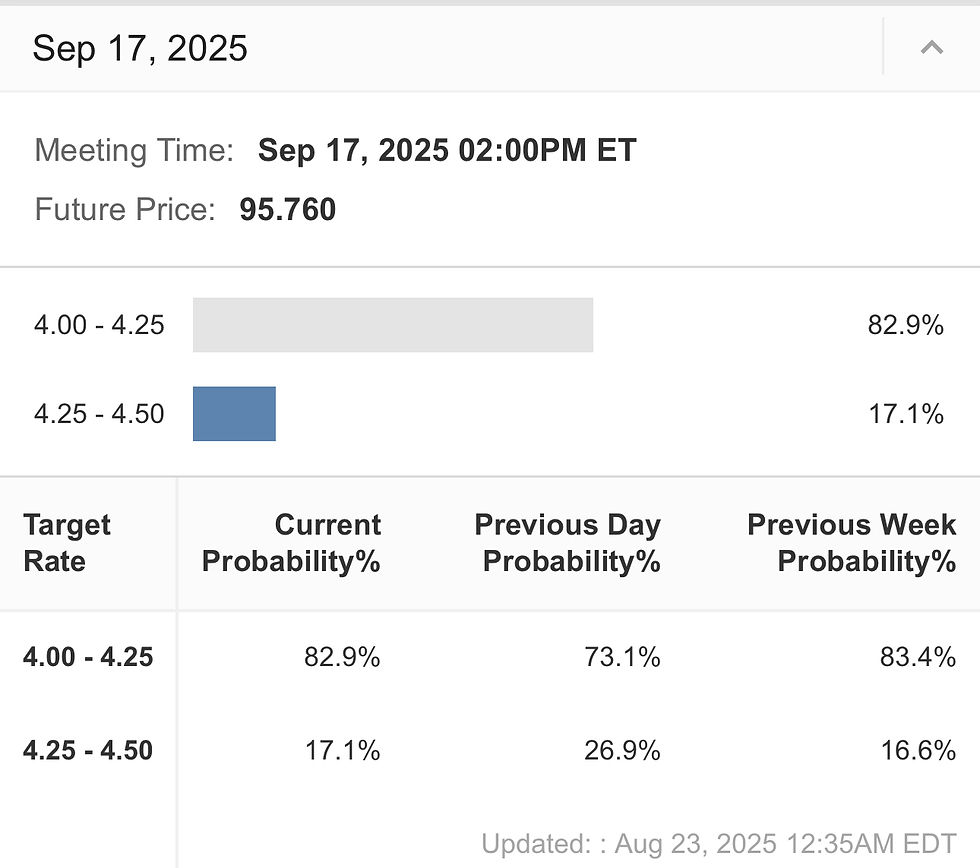

The Fed chairman speech at Jackson Hole lived up to the hype. Perhaps the two key sentences from it were: (1) ”risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation.“ and (2) “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.“ as those words hit the tape, like a spring that has been compressed, equity indices spiked up, the dollar sank and the 10 year yield dropped. Powell’s remarks signaled potential interest rate cuts as early as September 2025, given cooling labor market conditions and a shifting balance of risks. However, he tied decisions to incoming data, such as the September jobs report and CPI, and highlighted external pressures like tariffs potentially causing temporary price spikes. As you can see below, the odds for a cut jumped to 83%, but it’s likely there will be some adjustments once the data comes out.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments