Repricing

- Gustavo A Cano, CFA, FRM

- Aug 14, 2025

- 1 min read

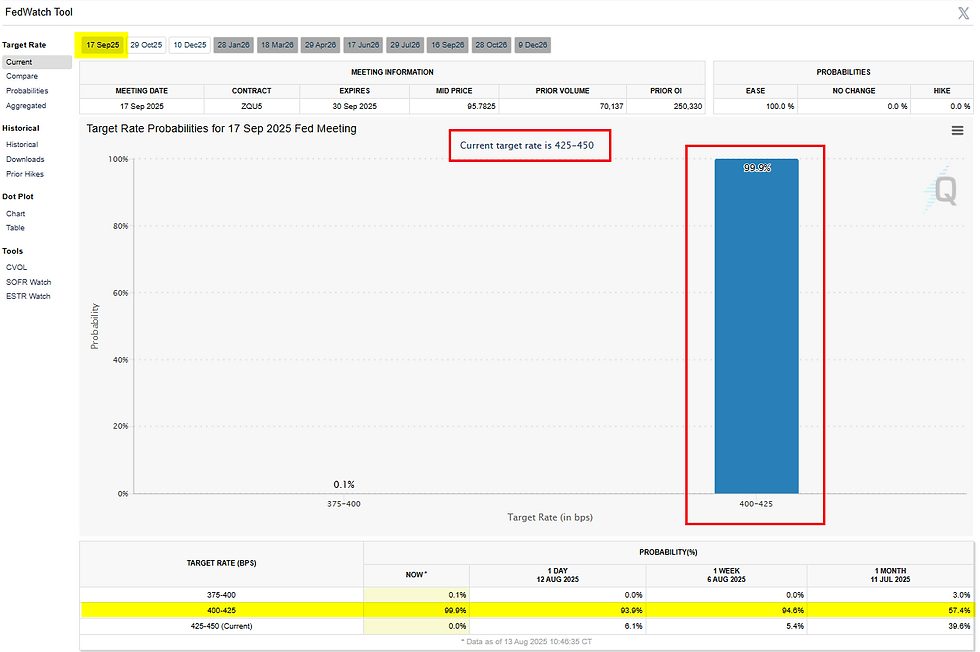

There has been an incredible repricing in the odds for a rate cut in the September FOMC meeting. As you can see below, we have gone from 57% a month ago, to almost certainty now, with 99.9% probability of a 25 bps cut. Furthermore, treasury secretary Bessent is pushing for 50 bps to compensate for the lack of action in prior meetings. The 2 year treasury bond, the most sensible one to Fed fund rates, is trading at 3.66%, signaling almost 3 cuts from current levels, and the dollar index keeps weakening at an orderly pace. The 10 year Treasury bond yield is also down to 4.21%, which will seem to indicate that the bond market does not see a problem with the rate cuts, should they happen, when it comes to inflation. All this means we’re either set up for a huge disappointment, if Powell decides it’s still not time to cut, or the market will reinforce the narrative that tariffs are not inflationary and that a monetary stimuli is what we need now to keep the economy going at full speed. Trump’s goal for Fed Funds is 2%, with no economic justification. And by looking at how the market is behaving, that’s what we’re going to get from now till December.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

7