Short

- Gustavo A Cano, CFA, FRM

- Aug 9, 2025

- 1 min read

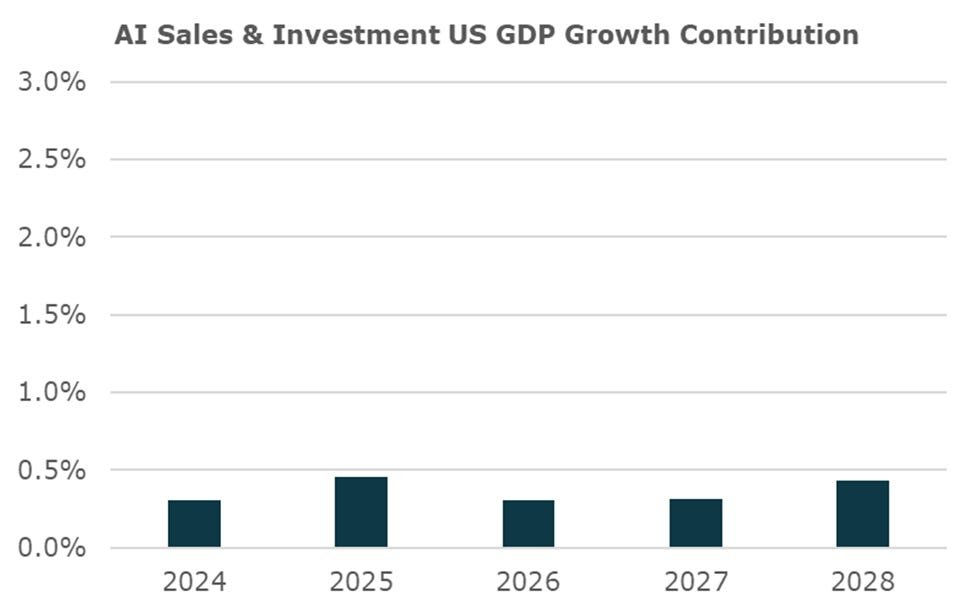

Despite the president efforts to raise money through tariffs, gold reserves revaluation and the FNMA & FRE IPO, those one offs will not be anough to cover the annual gap created by excess government spending over revenues. The hope is that AI will grow so much that we will see a significant impact in the U.S. GDP that will dwarf the deficit. But as you can see in the chart below, reality may fall short of the expectations. Hyperscalers (Amazon, Google, Meta, Tesla, MSFT) are currently investing collectively around 1% of US GDP, and some of them are tapping the private credit markets to finance their respective AI infraestructure. But the short term impact may not even be enough to return the investment in the next 3-5 years. Longer term, it’s almost inevitable, like it happened with the internet. But who/what will cover the interim?

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments