Strategic shift

- Gustavo A Cano, CFA, FRM

- Aug 20, 2025

- 2 min read

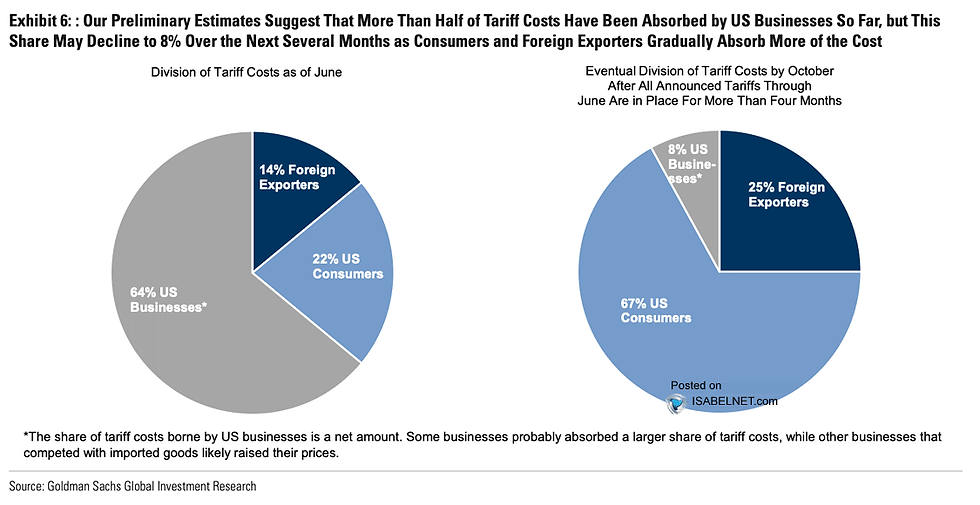

Inflation for the European Union was published today and showed that CPI was up 2% YoY, right on target for central bankers, and core CPI (ex food and Energy) slightly higher at 2.3%. Two observations: (1) energy is helping at his point but it can turn hot any moment and add a few decimal points to inflation. (2) the EU has been lowering rates over the last 12 months and there is no sign of inflation, unlike the U.S. which doesn’t find a way to lower the cost of living to 2%, to be able to lower interest rates. In the chart below, you can see an analysis of the impact of tariffs that tells us that so far, companies in the US have absorbed 2/3 of the costs associated with tariffs. But as time goes by, those cost are going to be transferred to the consumer (chart on the right) and they should be reflected on the CPI, and PCE. It is very possible that we will see a spike in inflation coinciding with the rate cuts, which will bring anxiety to the long end of the U.S. treasury curve. Tariffs have created a different dynamic in the U.S. vs the world, and that’s why inflation is stickier. Whoever is chosen for the Fed chair will have the difficult task of pleasing the White House by lowering rates while convincing investors that inflation is under control. The key may be on the other side of the mandate: unemployment revisions are set to rewrite the narrative of full employment. We are going to see weaker jobs reports going forward and the Fed will deviate the attention to that dynamic to build the case for rate cuts.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments