The Chairman gets a B+

- Gustavo A Cano, CFA, FRM

- Oct 15, 2025

- 1 min read

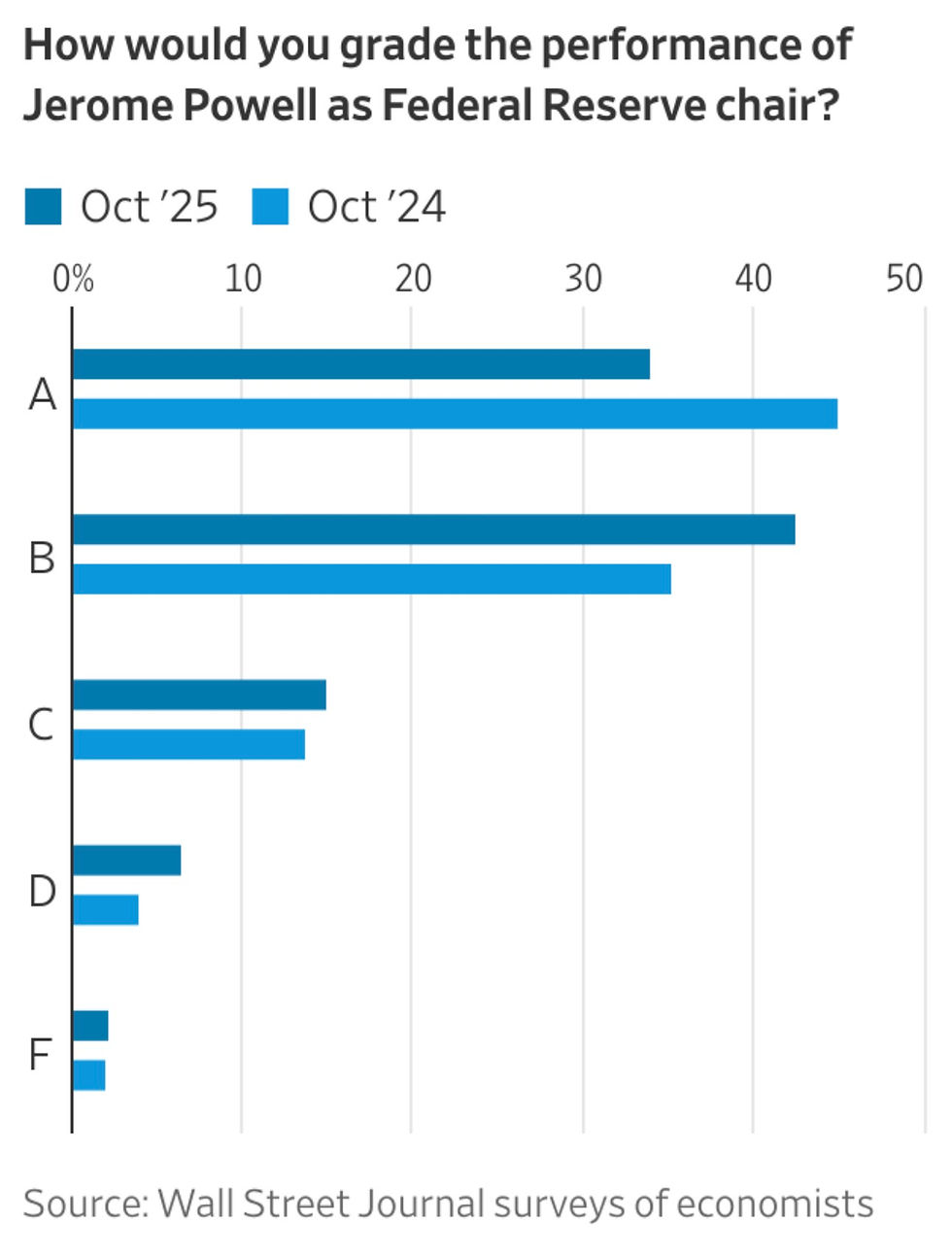

Federal Reserve Chair Jerome H. Powell delivered his keynote address, titled “Understanding the Fed’s Balance Sheet,” at the 67th Annual Meeting of the National Association for Business Economics (NABE) in Philadelphia. This was his final public remarks before the Fed’s October 28-29 policy meeting. The takeaways were: (1) The outlook for employment and inflation “has not changed much” since the September meeting. Powell signaled the committee is positioned for two more quarter-point cuts in 2025 (October and December), emphasizing that “downside risks to employment appear to have risen” and now outweigh inflation concerns. (2) In a major highlight, Powell indicated the Fed’s $2 trillion+ balance sheet reduction (since 2022) may conclude “in coming months.” He mentioned that early signs of liquidity tightening, suggest the process is nearing its end. Coincidentally, the WSJ published a set of surveys among economists: one in which Powell gets a B+(see chart below), and perhaps the most interesting one, where they ask economist who they think are the top three candidates for the Fed Chairman job (Waller, Bullard and Logan) and who they think will have the highest probability of winning the seat (Hasset, Warsh and Waller). Only Waller appears in both lists, and Kevin Warsh works with Stan Druckenmiller at Duquesne FO, like current Treasury a secretary Scott Bessent did, which is th one conducting the interviews for the job.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments