Treasury bonds issuance and the U.S. deficit

- Gustavo A Cano, CFA, FRM

- Aug 16, 2023

- 1 min read

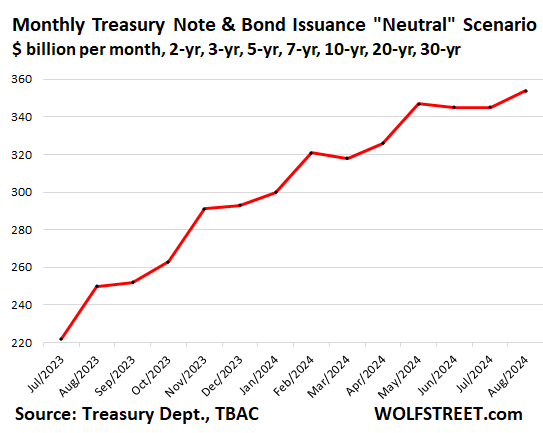

The US Treasury needs to finance the (huge) budget deficit the goverment is running. So far, they have been able to do it with #treasurybills, where they typically maintain a 15% -20% cap on the total debt in a way they don’t put too much pressure on the long end of the curve. However, issuance of long bonds will need to go up, in fact it’s been decided by #tbac (Treasury Borrowing Advisory Committee) monthly T-bond issuance will increase 60% by August 2024 ($220bn in July ‘23 vs $340bn expected), as you can see in the chart below. But that’s just one side of the equation, the supply side. On the demand side, the #federalreserve is a net seller of bonds through its #qt program, and #banks are not in a position to buy bonds in a meaningful way. #japan is too busy keeping its 10 year from going too high with its #ycc program and #china is busy trying to jump start its economic activity. Then, the big question is: who wil buy US treasuries, and at what yield?

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Comments