Careful what you wish for

- Gustavo A Cano, CFA, FRM

- Sep 15, 2025

- 1 min read

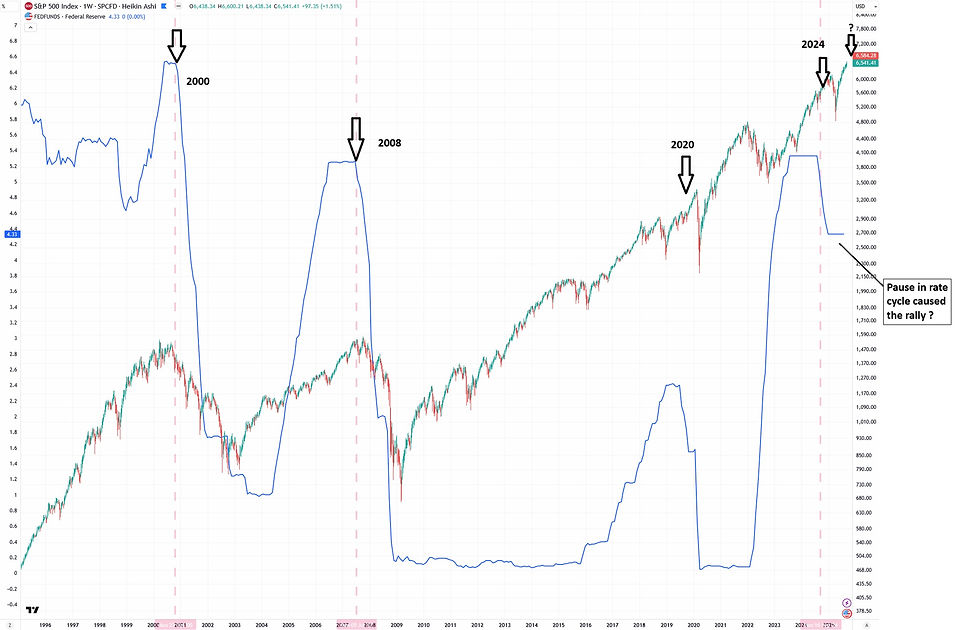

The week of the September FOMC meeting is finally here. As it stands today, the probability of a 25 bp cut is 98.1% with the remainder assigned to 50 bps. Inflation seems to have taken the back seat, and now its all about unemployment, at least for now. The scorecard shows that: (1) equity indices are at all time highs, (2) credit spreads are at an all time low, (3) the dollar index is at 97, showing some weakness, but without extremes, and (4) Gold is at an all time high. Bond yields have been trending up since the pandemic, but has be bit breached the 5% barrier yet. What has happened in the past when the Fed has started an easing cycle? The chart below shows a story we rather not see: over the last 30 years, every time an easing cycle begins, the equity market corrects. Whether it has a cause effect relationship or it has to do with market reflexivity, is debatable, but the chart shows that corrections are linked to rate cuts. If markets are destined to get the a rate cut on Wednesday, will they start a correction as well?

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments