Eastern worries

- Gustavo A Cano, CFA, FRM

- Aug 4, 2025

- 1 min read

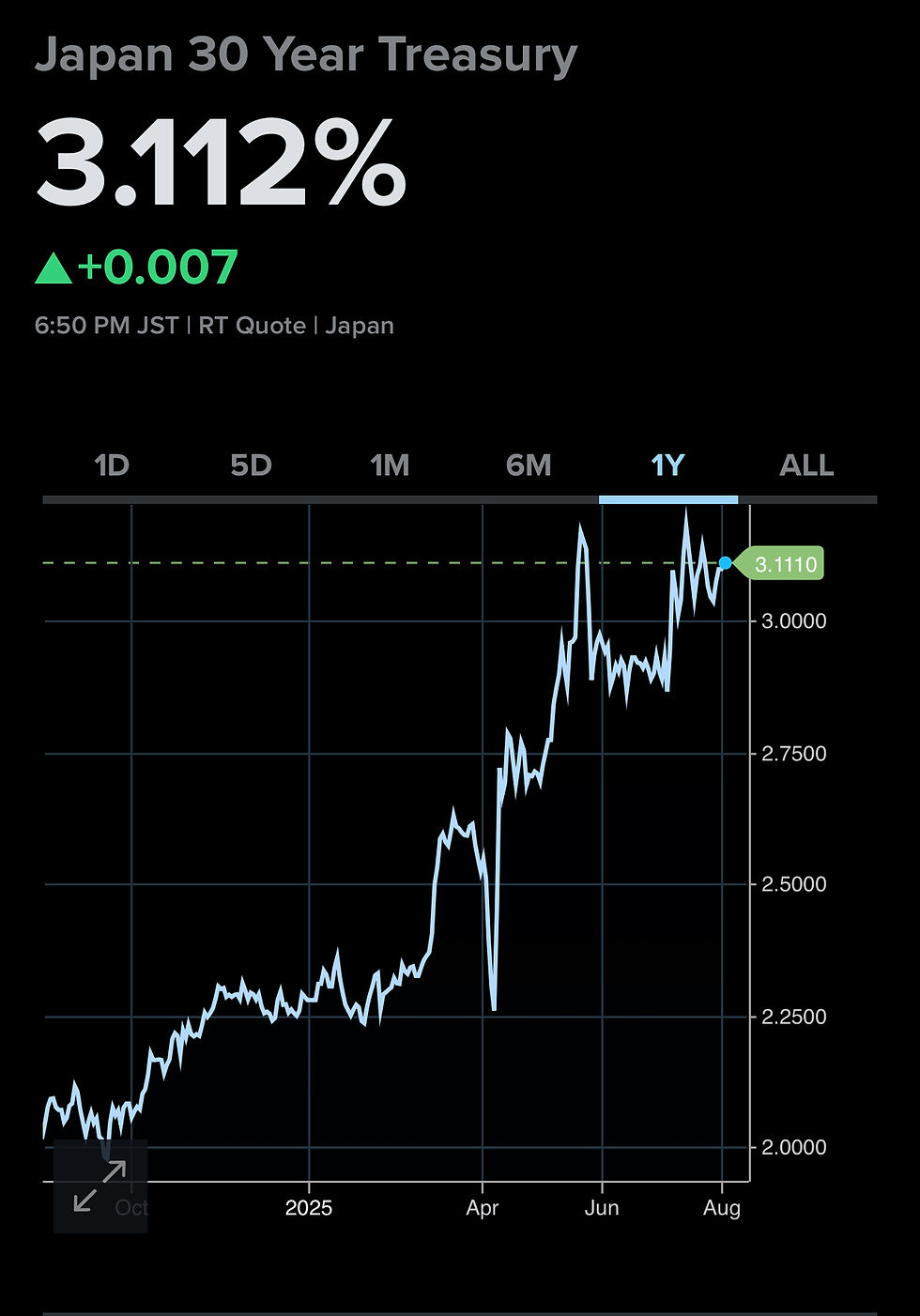

The week has started a little bumpy, as Japan 30 year bond is above 3.10% and 50% up from a year ago. The BoJ is trying to normalize monetary policy, abandoning Yield Curve Control (basically printing money to buy long term bonds to avoid higher cost of debt) without bankrupting the economy and creating liquidity crisis and debasing the Yen along the way. The BoJ still owns 50% of all the JGBs in the market, which amount to 260% of GDP, and therefore has massive market to market losses simply due to duration risk. And on the asset side of the balance sheet, they have $1.1Tn US treasury bonds, which at some point if pressure continues to mount wil be force to sell, at least partially to avoid a major disaster, but hey can create a bigger one at the other side of the Pacific Ocean here in the U.S., by creating selling pressure at a time where bond investors are already questioning if yields are too low compared to where they should be according to the fiscal status of the US. In 1998, a currency crisis that started with the Thai Bath spread like fire onto other Asian economies and blew up Long Term Capital management. Hopefully, this time is different (!!!).

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments