It doesn’t add up

- Gustavo A Cano, CFA, FRM

- Sep 11, 2025

- 1 min read

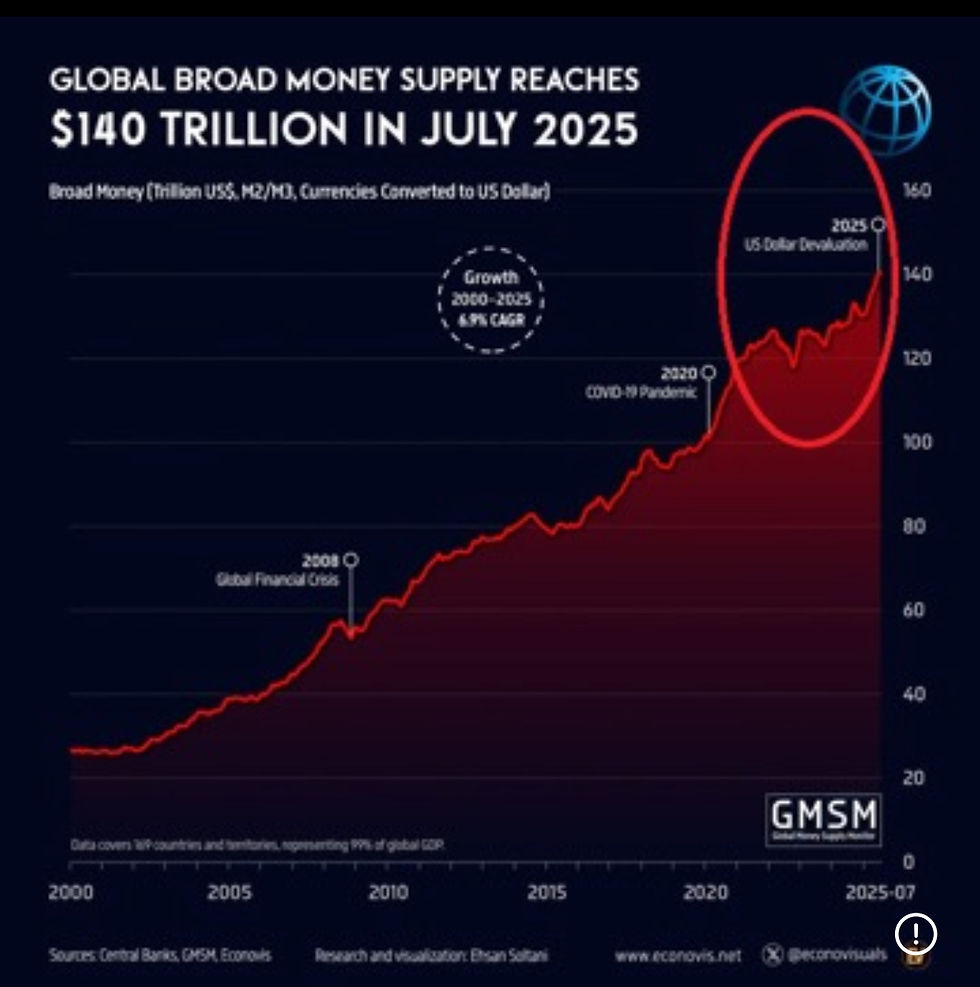

After a better than expected PPI yesterday, today it’s the turn of CPI. As with the payroll numbers, these statistics are published by the BLS, which is going through a credibility crisis after massive revisions in employment data. But the important point is that there are underlying pressures behind inflation. In the chart below, you can see a chart of the global broad money supply. It went up 9.3% in July alone and it’s now totaling $140Tn. Too much money chasing a limited number of goods, should be inflationary. And then we have tariffs. Turning our heads to unemployment for the time being, does not take the inflation problem away. And if the Fed ends up lowering interest rates next week, it will add more pressure to prices, unless, of course, we are in a recession or a significant slowdown, but we don’t know it yet. Gold keeps climbing, debt keeps going up and deficits continue to widen. And central banks around the world keep lowering rates, injecting more liquidity in the system. Governments are going to deflate the debt, while oficial inflation numbers keep being surprisingly benign.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments