Ripple effect

- Gustavo A Cano, CFA, FRM

- Oct 11, 2025

- 1 min read

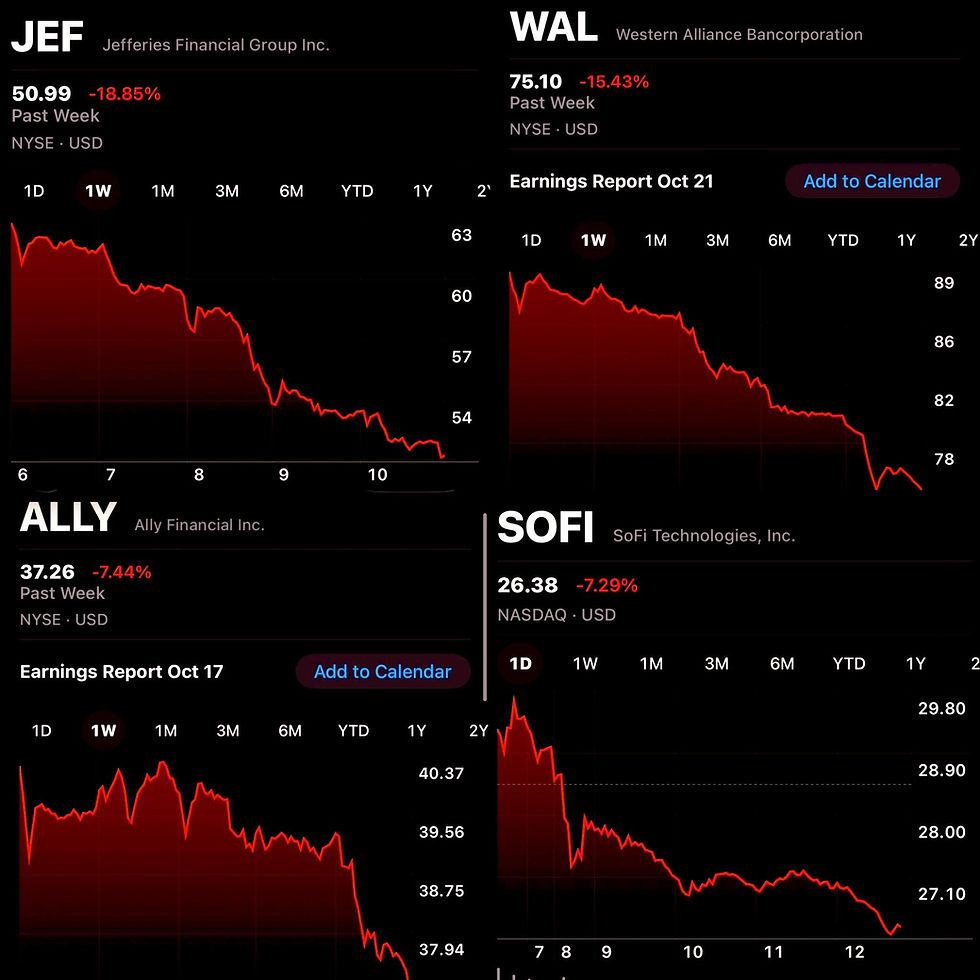

The market ended the week on a sour note. Trump announced what seems to be a temporary break on the negotiations with China, questioning his meeting with Xi in 2 weeks in Seoul, and applying 100% tariffs on Chinese goods starting right after the date of the meeting. The motive appears to be related to the negative from China to export rare earth metals to the U.S, which are becoming key components for the defense industry. But three are other factors on top of the geopolitical ones: (1) the default of First Brands is raising questions about the status of the credit market, particularly in private credit, and wether there are more cases like this one that will start to pop up. This is affecting some medium sized banks (see chart below), with the additional fear of contagion on the financial system. (2) the Yen carry trade: as the yen weakened following the results of the elections, program trading systems may have started to unwind the trade, which implies selling US assets (equities for the most part) to repay the debt in Yen after its recent weakening. US Treasury bond yields were mostly flat, and the dollar weakened as a result of the unwinding. Bitcoin was hit hard, signalling that at this point it may not be a safe haven, dominated by speculators. The VIX index spiked up as market feared a potential ripple effect.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments