top of page

Connect, Aggregate

and Analyze

Fund@mental is the premier professional technology platform within the wealth management community.

Its utilization of advanced research ensures unbiased access to the finest investment products and top-tier analysis.

Easy sharing

Simple by design.

Powerful by necessity.

Access our Insights with

the click of a button

Misdirection

President Donald Trump has escalated his longstanding criticism of Federal Reserve Chair Jerome Powell and the Fed through the Department of Justice (DOJ), primarily by initiating a criminal investigation into Powell’s congressional testimony. This action is widely viewed across sources as an attempt to exert political pressure on the central bank to lower interest rates, amid Trump’s repeated public threats to fire Powell or sue him for “gross incompetence.” The investigatio

Gustavo A Cano, CFA, FRM

Jan 122 min read

Trade details

The U.S. trade deficit was narrowed as published yesterday with October figures, due to government shutdown. This is therefore a backward looking figure. But it’s still relevant to see trends. The question is, do we have a trend down for this deficit? Look a the charts below: the September figures was $48.1Bn, and the newly released October one was $29.4Bn, a reduction of $18.8Bn. This is good, and should give credit to this administration. But the details are important. The

Gustavo A Cano, CFA, FRM

Jan 111 min read

Affordability and midterms

President Trump is already campaigning hard for the midterms. So far he has announced: (1) $2000 checks to americans coming from tariffs, (2) Fed fund rates will be lower, putting great pressure on the Fed, (3) lower gasoline prices as a consequence of Venezuela’s intervention, (4) lower mortgage rates thanks to $200bn mortgage bonds purchases by the GSEs, (5) which he intends to relist in the market promptly, bringing more money to the U.S. taxpayer (or so he says), (6) he h

Gustavo A Cano, CFA, FRM

Jan 101 min read

Does the end justify the means

It is remarkable to witness the may ways this administration is intervening the market with similar effects than QE (quantitative easing) without being QE. First, the Fed started late last year a program to buy $50Bn a month in Treasury Bills (less than 1 year), and because the securities have no duration, it’s not considered QE (??). This operation does have an impact on M2 (the monetary base), since in the absence of these purchases, the Fed balance sheet would be reduced.

Gustavo A Cano, CFA, FRM

Jan 91 min read

Unstable equilibrium

It’s becoming a full time job to follow up on all the events that are going on in the world the first week of the year. The pace is frenetic. On the domestic front, the job market is deteriorating, with less job openings than unemployed people for the first time in almost 4 years. This helps the president lower rates, but it may become dangerous if it continues to worsen. And since it seems no more government jobs will be added, and corporate america is embracing AI, we’re go

Gustavo A Cano, CFA, FRM

Jan 82 min read

Greenland

The Trump administration has started the year in some sort of a geopolitical rush. The president may not want to risk his agenda to a potential loss of control of the House and the Senate in th mid term elections. First, Venezuela, then Iran, where military assets are reportedly being deployed in the Middle East, to befriend and support the regime change in old Persia. The next one in line is Greenland. Greenland’s position bridges North America, Europe, and the Arctic, makin

Gustavo A Cano, CFA, FRM

Jan 72 min read

Top ten risks

Eurasia Group’s Top Risks for 2026 report, has been published today. It highlights a volatile global environment, with the United States emerging as the primary source of risk due to domestic political shifts under President Trump. the Top 10 Risks are: 1. US political revolution : Trump’s attempts to consolidate power make the US the biggest global risk driver. 2. Spheres of influence : Growing division of the world into competing blocs led by major powers. 3. Sell Amer

Gustavo A Cano, CFA, FRM

Jan 61 min read

Zero sum game

The new year has started the same way the old one finished, with an increase in national debt. During 2025, U.S. debt increased by $2.3Tn, and at current pace, even with tariff revenue, we will reach $40Tn by August, maybe sooner, if we continue to have intensive military campaigns around the globe. What’s interesting is that the long end of the Treasury curve is not moving that much. Perhaps because there is very low supply from the U.S. treasury that prefers to maintain the

Gustavo A Cano, CFA, FRM

Jan 52 min read

Another proxy war

It’s difficult to talk about anything else than Venezuela today. The dust has not settle yet, and the official explanations, what was said (and what wasn’t), clarifies a little bit more the real intent of the operation. Was it about drugs? Sure. Was it about oil? Absolutely. Was it about the Monroe Doctrine? Unequivocally. Was it about something else? Likely. 80% of oil exports from Venezuela go to China. And it’s transacted in Yuan. In other words, away from the U.S. dollar

Gustavo A Cano, CFA, FRM

Jan 41 min read

Macro is taking the wheel

We have not completed the first week of 2026, and you can already tell that this is going to be a year to remember. The geopolitical landscape is already at full steam: in Iran, there is a revolution in the streets to take down the Islamic revolution that started in the late 70’s, and in Venezuela, the U.S. Air Force is bombing strategic assets of the Maduro regime, which clearly points to a leadership and government change. And that’s only in day 3 of the year. In the chart

Gustavo A Cano, CFA, FRM

Jan 32 min read

Longest drawdown

The U.S. bond market, measured by the U.S. Aggregate Index has been suffering for 65 months. That is by far, the longest in history, and it’s not clear if 2026 will end the drawdown. Since the 80’s, when Paul Volcker raised rates to break the back of inflation, bonds have been on a bull market fueled by a downtrend in interest rates rates, which ended with zero interest rates, and since 2021 has started to reverse the trend, partly due to inflation fears, and partly due to th

Gustavo A Cano, CFA, FRM

Jan 21 min read

Silver plumbing

Silver had an incredible year in 2025. Triple digit returns, with a structural supply-demand imbalance that is pushing prices up. But what’s even more incredible, and not so visible, is the plumbing of the silver market. In simple terms: (1) the spot market tells us the price of an ounce of silver today. It trades in London, Dubai and Shanghai. It’s the physical market. Silver bars need to comply with certain characteristics (weight, purity, dimensions), which is provided by

Gustavo A Cano, CFA, FRM

Jan 12 min read

AI contribution scorecard

It’s already been 3 years since the public announcement of ChatGPT, the most popular AI powered chatbot. Since then, AI related companies have taken the world at a frenetic pace, to the point where it’s difficult to find a publication, or have a conversation where the technology is not present. So much so, that we have been promised a messiah that will save us from debt, unemployment and inflation. What’s the scorecard for the AI toddler? Take a look at the charts below; on t

Gustavo A Cano, CFA, FRM

Dec 30, 20252 min read

Predictions

Three trading days before year end, and predictions for next year are starting to come out. Predictions are usually of low value, with the notable exception that allows you, the investor, to know what the consensus view is. Since investing is a zero sum game for the most part, betting on those areas where consensus might be wrong, provides big rewards. In the chart below you can see 25 predictions organized by theme: markets, economy, technology, geopolitics and everything el

Gustavo A Cano, CFA, FRM

Dec 29, 20251 min read

The debt bomb

Global debt keeps going up. Both in absolute terms and relative to global GDP. It has reached $346Tn dollars as of Sept 2025 and represents approximately 338% of global GDP. Since the dollar is weakening against most currencies, when expressed in USD, debt has a currency component that has pushed the avokute level up, but that’s clearly not the root of thr problem. The relative part is the tricky one: the red line you see on the chart below measures debt over GDP, and that r

Gustavo A Cano, CFA, FRM

Dec 28, 20251 min read

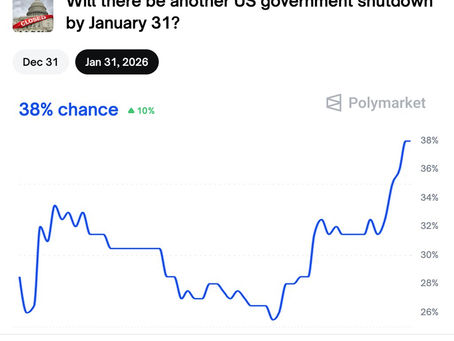

Shutdown again?

As of today (Dec 27th), the federal government is operating under a continuing resolution (CR) enacted in November 2025. This CR ended a 43-day shutdown that began on October 1, 2025, by providing full-year funding (through September 30, 2026) for a few areas, like Agriculture/FDA, Military Construction/Veterans Affairs, and the Legislative Branch, while extending temporary funding at prior levels for most other agencies only until January 30, 2026. But if Congress and Presid

Gustavo A Cano, CFA, FRM

Dec 27, 20251 min read

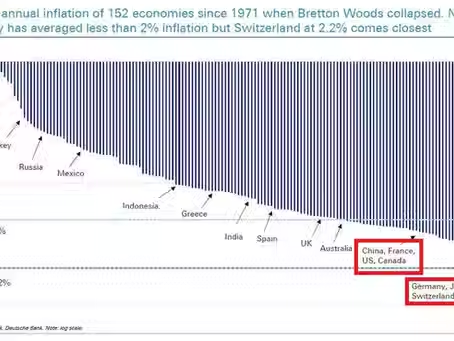

High stakes

One of the big topics for the new year is inflation. Will global economies be able to contain it, after massive rate cuts, or will it come back for a second wave similar to the 80’s? To get some perspective, the chart below shows the average annual rate of inflation for 152 countries since 1971, the year Richard Nixon broke the gold standard and the world abandoned the Bretton Woods agreement to become 100% fiat. Most Central Banks have a “price stability” mandate, that for s

Gustavo A Cano, CFA, FRM

Dec 26, 20252 min read

Silver Christmas

What is happening in the silver market is nothing sort of remarkable. Over the last month, silver sport price has climbed almost 42%, for an incredible 143% YTD return. The imbalance between supply and demand that you can see on the chart below, and the dual “personality” of silver as precious metal and industrial component of solar panels, EVs, and chips is creating an incredible squeeze that is pushing the price up. As a commodity is also benefiting from the fiat currency d

Gustavo A Cano, CFA, FRM

Dec 25, 20251 min read

Strong growth, low credibility

The Bureau of Economic Analysis (BEA) released yesterday the initial estimate for third-quarter 2025 GDP . This report was delayed due to a 43-day federal government shutdown in October–November 2025, which disrupted data collection. It combines elements typically found in the advance and second estimates, replacing those releases. A revision is scheduled for January 22nd, 2026. The number was very good, with a 4.3% annualized growth rate, almost 1% above consensus. In fact

Gustavo A Cano, CFA, FRM

Dec 24, 20252 min read

Sources of retuns

American exceptionalism took a breather in 2025. Every relevant market performed better than the S&P500 this year, as you can see in the chart below. It’s interesting to see the breakdown and sources of performance from the other markets compared to the US. For instance, one big component was the weakness of the U.S. dollar, which boosted European markets returns (gray component). Second, the multiple expansion did not contribute meaningfully in the U.S., since it was already

Gustavo A Cano, CFA, FRM

Dec 23, 20251 min read

©2024 Fund@mental. All rights reserved

bottom of page