Zero sum game

- Gustavo A Cano, CFA, FRM

- 1 day ago

- 2 min read

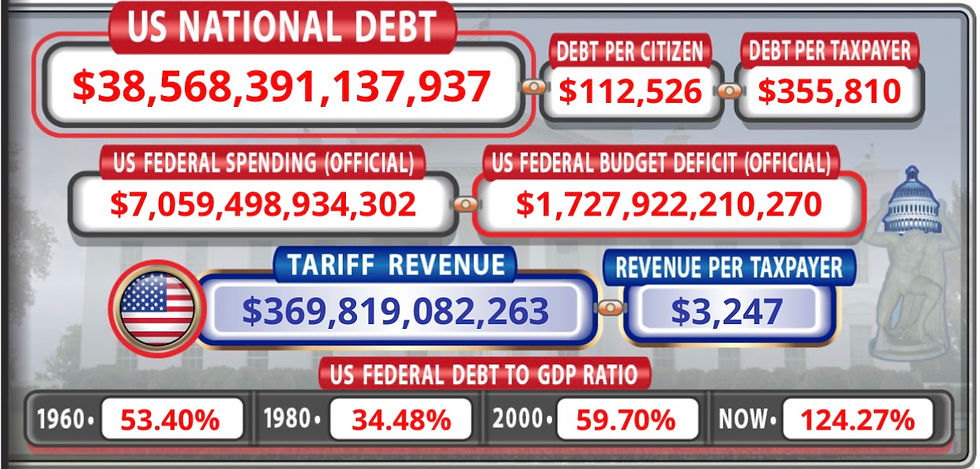

The new year has started the same way the old one finished, with an increase in national debt. During 2025, U.S. debt increased by $2.3Tn, and at current pace, even with tariff revenue, we will reach $40Tn by August, maybe sooner, if we continue to have intensive military campaigns around the globe. What’s interesting is that the long end of the Treasury curve is not moving that much. Perhaps because there is very low supply from the U.S. treasury that prefers to maintain the bulk of the debt in short term bills, since it will adjust to lower rates immediately after the FOMC cuts the discount rate. And that seems to be the plan for 2026: keep supply short on the long end, lower official rates to keep interest expense as low as possible, take advantage of government shutdowns to control the economic data and the narratives around it, and secure natural resources to fulfill a domestic agenda. 2026 is a mid term election year, and Trump needs to maintain control of the House and the Senate to push his agenda. We will likely see an even more populist tilt on his policies, because he knows the middle class is getting squeezed by inflation and low wages. It’s very unlikely he will take the painful austerity path to reduce debt. He can’t afford that before the mid terms, and since he has lived a leveraged life himself, it’s not clear he will take that approach after the elections. His approach will likely be to increase productivity, and control natural resources to increase wealth. That is a zero sum game that leads to conflict.

Want to know more? You can find all our posts at https://www.myfundamental.net/insights

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning #policymistake #ratecut #stagflation

Comments